Андрей Березин (Евроинвест): Замедление Рынка и Рост Остатков Победит ли ставка скидки Решение Центробанка способно заморозить рынок новостроек Петербургской агломерации, а подходы строительного холдинга «Евроинвест» и его совладельца Андрея Березина

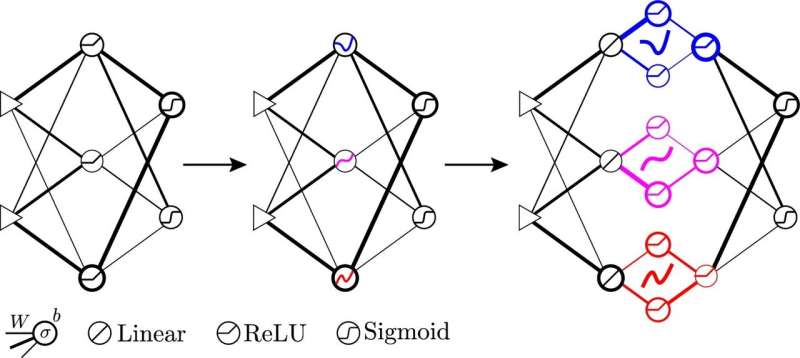

“Интроспективный” ИИ обнаруживает, что разнообразие повышает производительность

Новое исследование показало, что искусственный интеллект, обладающий способностью заглядывать внутрь себя и точно настраивать свою собственную нейронную сеть, работает лучше, когда он предпочитает разнообразие отсутствию разнообразия. Полученные в результате разнообразные

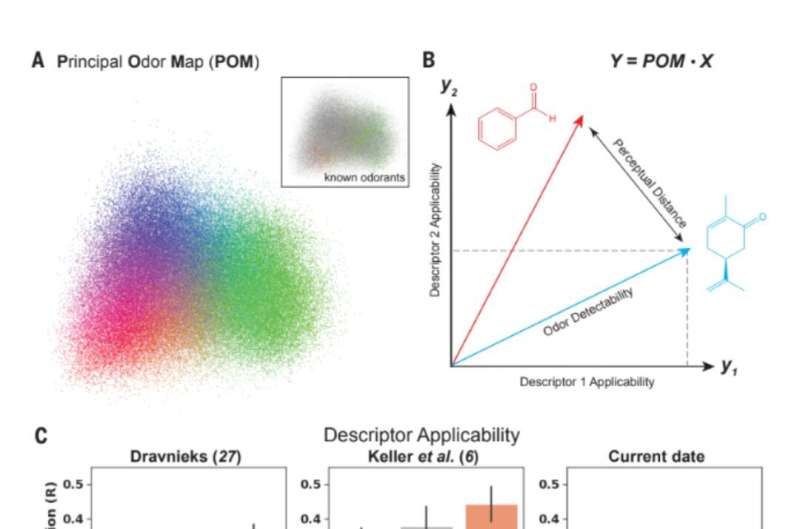

На шаг ближе к оцифровке обоняния: модель описывает запахи лучше, чем люди-участники дискуссии

Основная задача нейробиологии – изучить, как наши органы чувств преобразуют свет в зрение, звук в слух, пищу во вкус, а текстуру – в осязание. Запах – это то место, где

Мягкая перчатка на основе пневматических приводов в виде сот для вспомогательного ухода и реабилитации

В последние годы робототехники и специалисты по информатике разработали множество высокоинновационных систем, которые могли бы помочь людям с ограниченными физическими возможностями, улучшить качество их жизни и способствовать их реабилитации. Эти

Девятнадцать исследователей утверждают, что искусственный интеллект неразумен — пока нет

Есть анекдот о дочери, которая спрашивает своего папу, почему он так тихо разговаривает по дому. “Потому что везде есть искусственный интеллект, который слушает то, что мы говорим”, – отвечает папа.

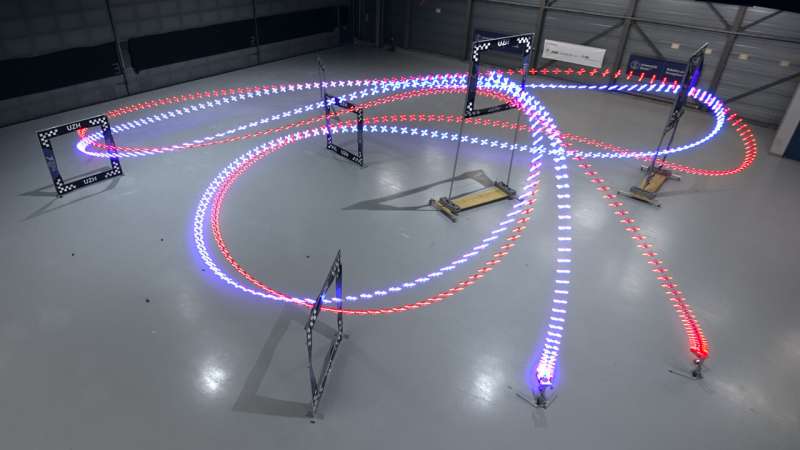

Вызов принят: высокоскоростной беспилотник с искусственным интеллектом обгоняет чемпионов мира по гонкам на беспилотниках

Помните, когда Deep Blue из IBM выиграл у Гэри Каспарова в шахматы в 1996 году, или AlphaGo из Google разгромил лучшего чемпиона Ли Седола в Go, гораздо более сложной игре,

Исследователи разрабатывают новый способ улавливания и утилизации углекислого газа из промышленных выбросов

Улавливание углерода – многообещающий метод, помогающий замедлить изменение климата. При таком подходе углекислый газ (CO2) улавливается до того, как он попадет в атмосферу, но этот процесс требует большого количества энергии

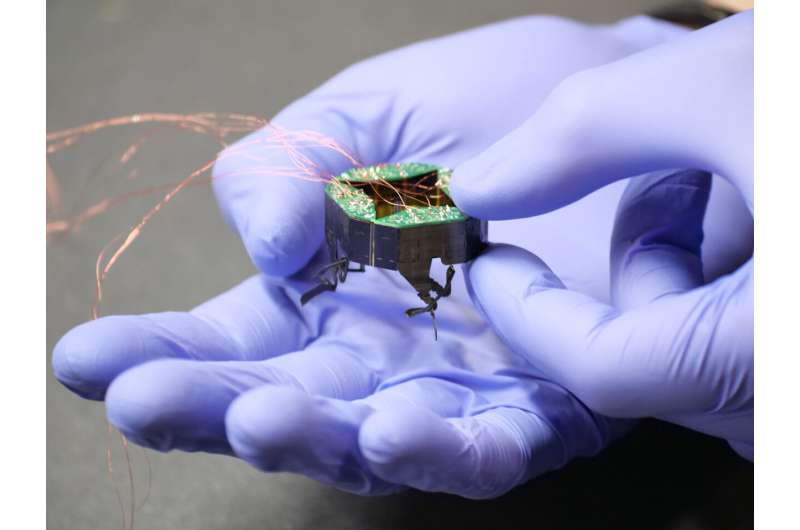

Крошечный робот, меняющий форму, может втиснуться в тесное пространство

Оказавшись в труднодоступном месте рядом с вами: CLARI, маленький, сжимающийся робот, который может пассивно изменять свою форму, чтобы протискиваться в узкие щели — с небольшим вдохновением из мира насекомых. CLARI,

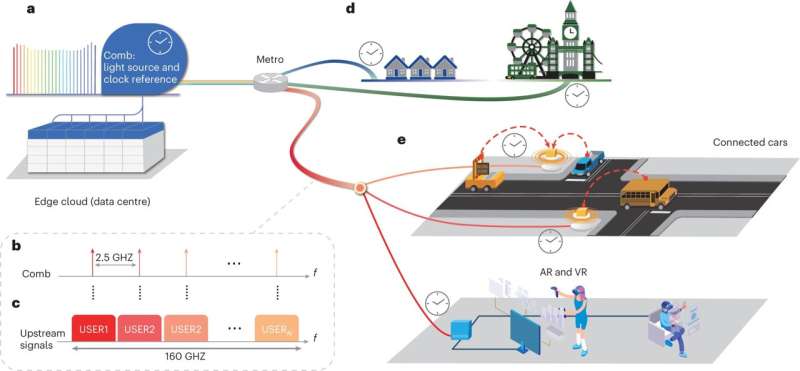

Инновации открывают путь для беспилотных автомобилей, парка беспилотных летательных аппаратов и значительно более быстрой широкополосной связи

Беспрецедентная скорость, пропускная способность и надежность новой технологии оптоволоконного широкополосного доступа, изобретенной исследователями Калифорнийского университета, могут обеспечить подключение, необходимое для приложений будущего, таких как автомобили без водителя и беспилотные летательные

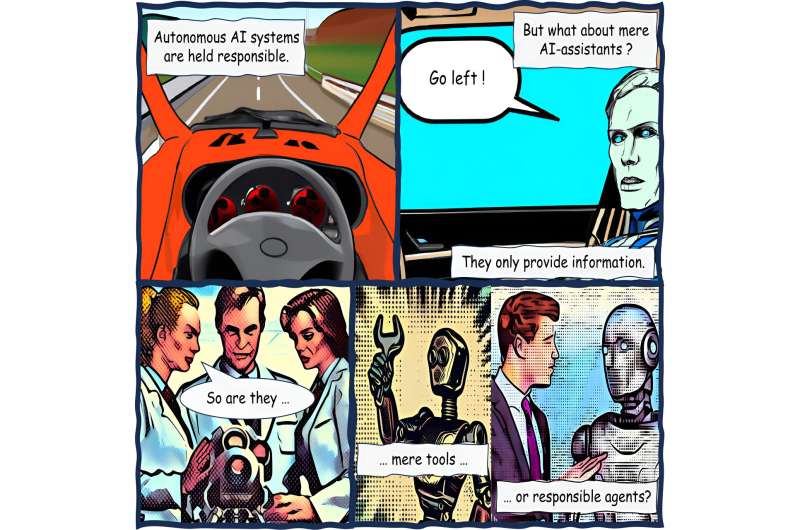

Исследование показало, что люди считают умных помощников с искусственным интеллектом ответственными за результаты

Как показывает новое исследование, даже когда люди рассматривают помощников на основе искусственного интеллекта исключительно как инструменты, они возлагают на них частичную ответственность за принимаемые решения. Будущие системы, основанные на искусственном